Welcome to Aave App

Earn up to 1.00% 1.00% on your Savings.

Earn interest every second with industry-leading rates and balance protection up to $1M.1

Better rates. Industry-leading protection.

Grow your Savings

Unmatched savings rates.

Up to 22× higher than traditional savings accounts.

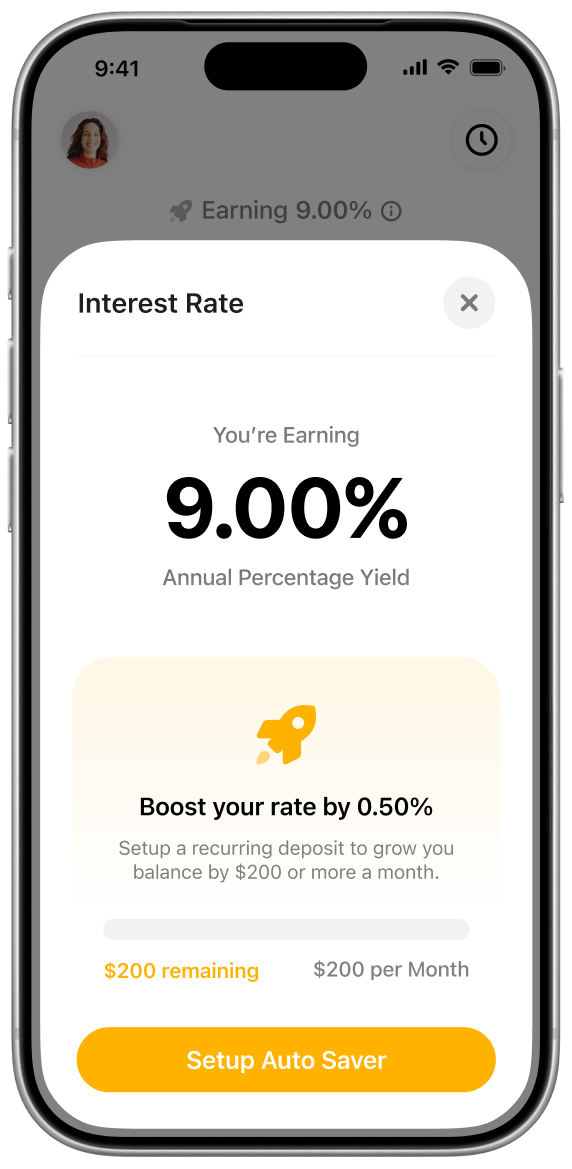

5.00% APY + Boosts

Balance Protection

Your balance. Protected.

Your money is protected up to $1,000,000 per Aave App account.

Aave is introducing insurance-backed protection for Aave App customer balances, providing up to $1,000,000 in coverage per eligible customer once active, subject to maximum policy limits and conditions. Full details, including limits and eligibility, will be shared upon launch.

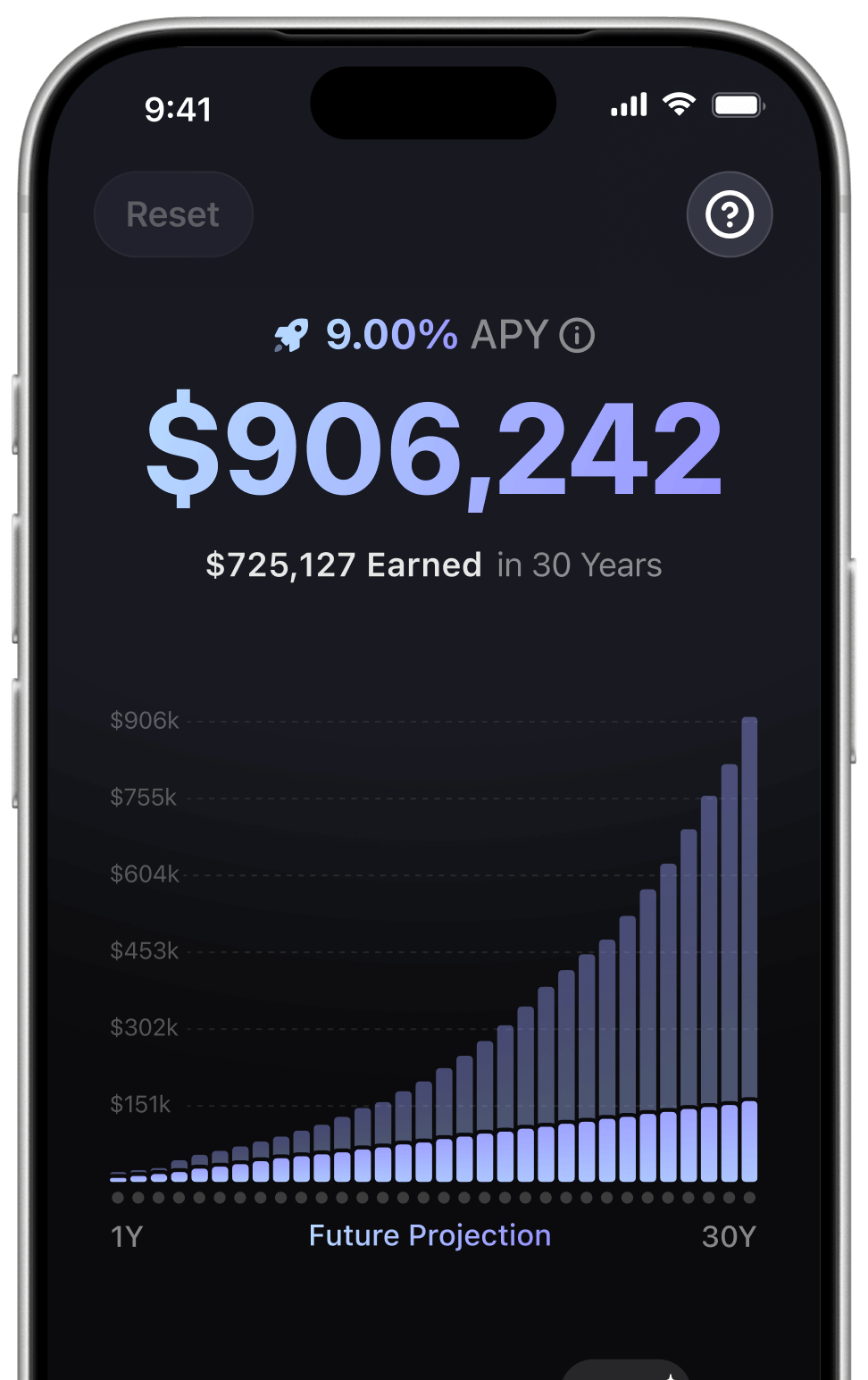

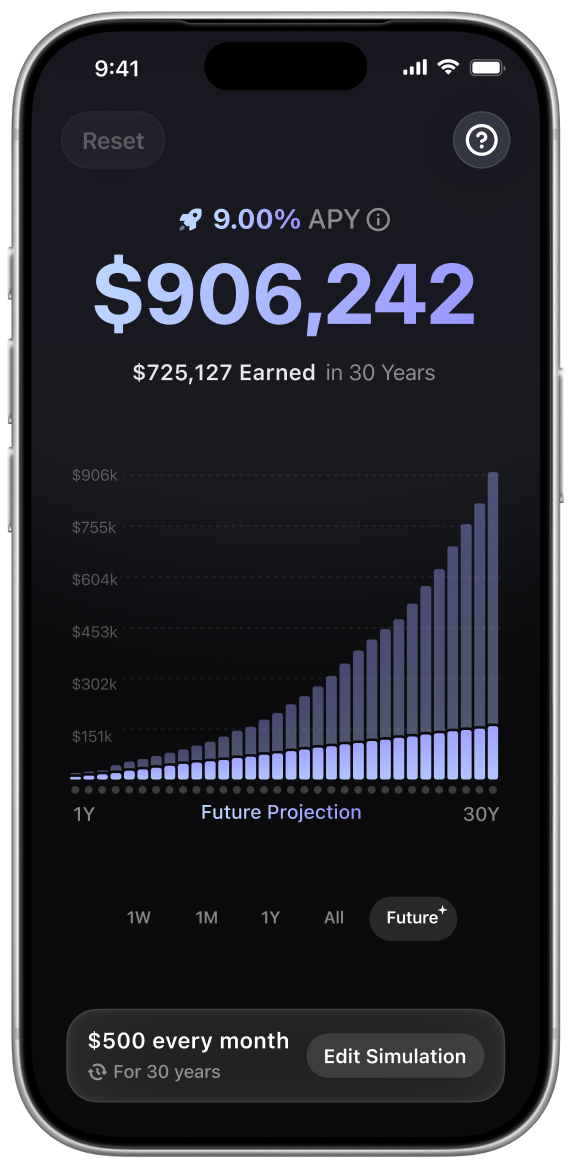

Simulate your savings.

Simulation

You’re earning a base of 5.00% APY plus:

0.75% 0.75% for inviting friends.- 1.00% for early setup.

- 0.50% for qualifying recurring contributions.

Future Balance

Today

30Y

Compare your Future Balance

Rates may vary. Learn More.

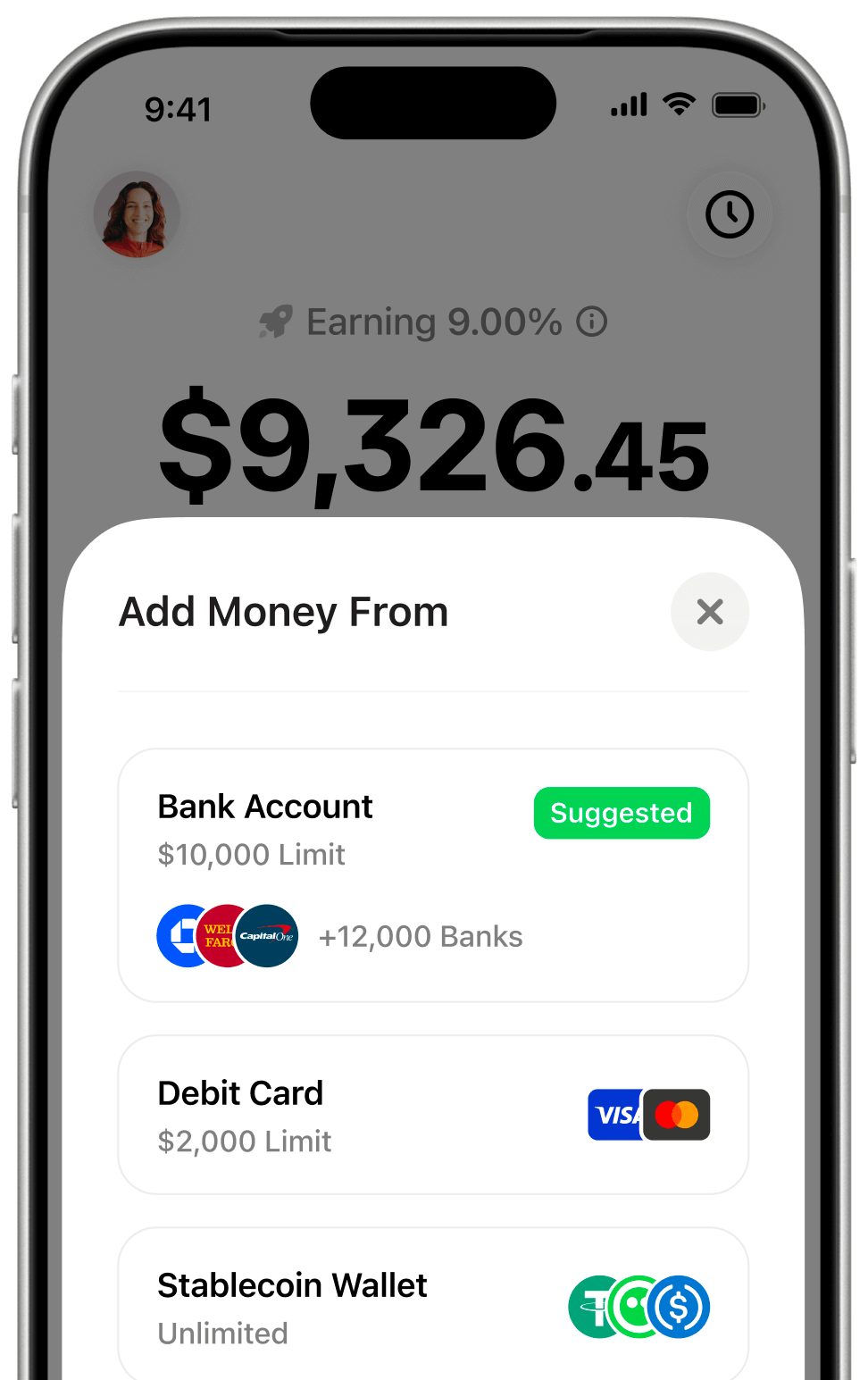

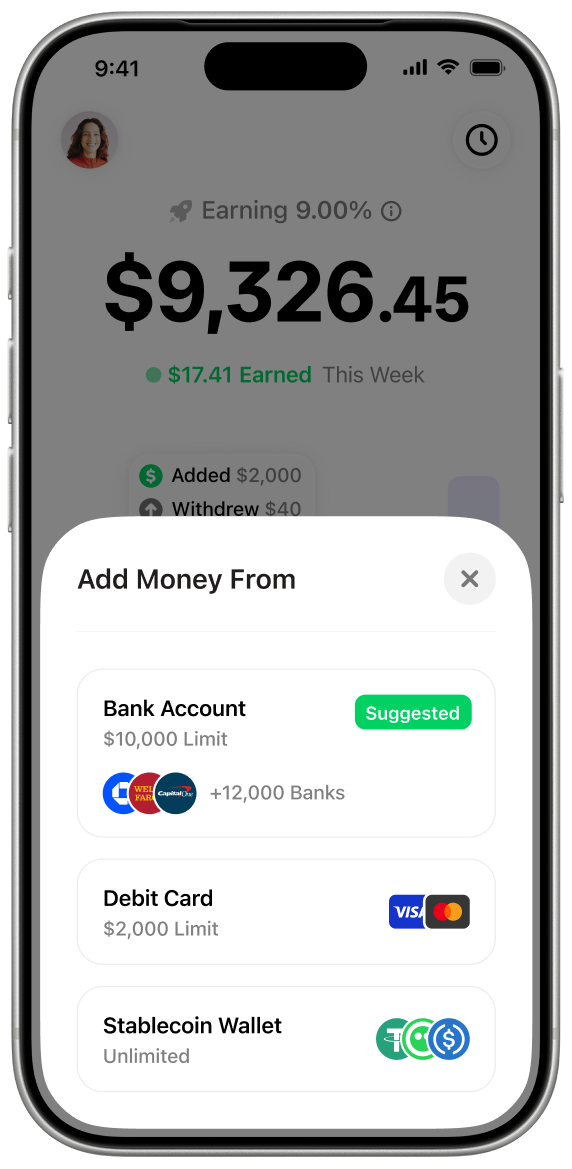

Money in, money out. It’s that easy.

Payment Methods

Add money from anywhere.

Connect to over 12,000 banks and cards.

Your money, your rules

Withdraw anytime.

Access your savings whenever you need.

Step into the future.

Auto Saver

Automate your savings.

Setup recurring deposits and reach your savings goals.

Compounding 24/7/365

Every second counts.

Your balance grows every second on Aave.

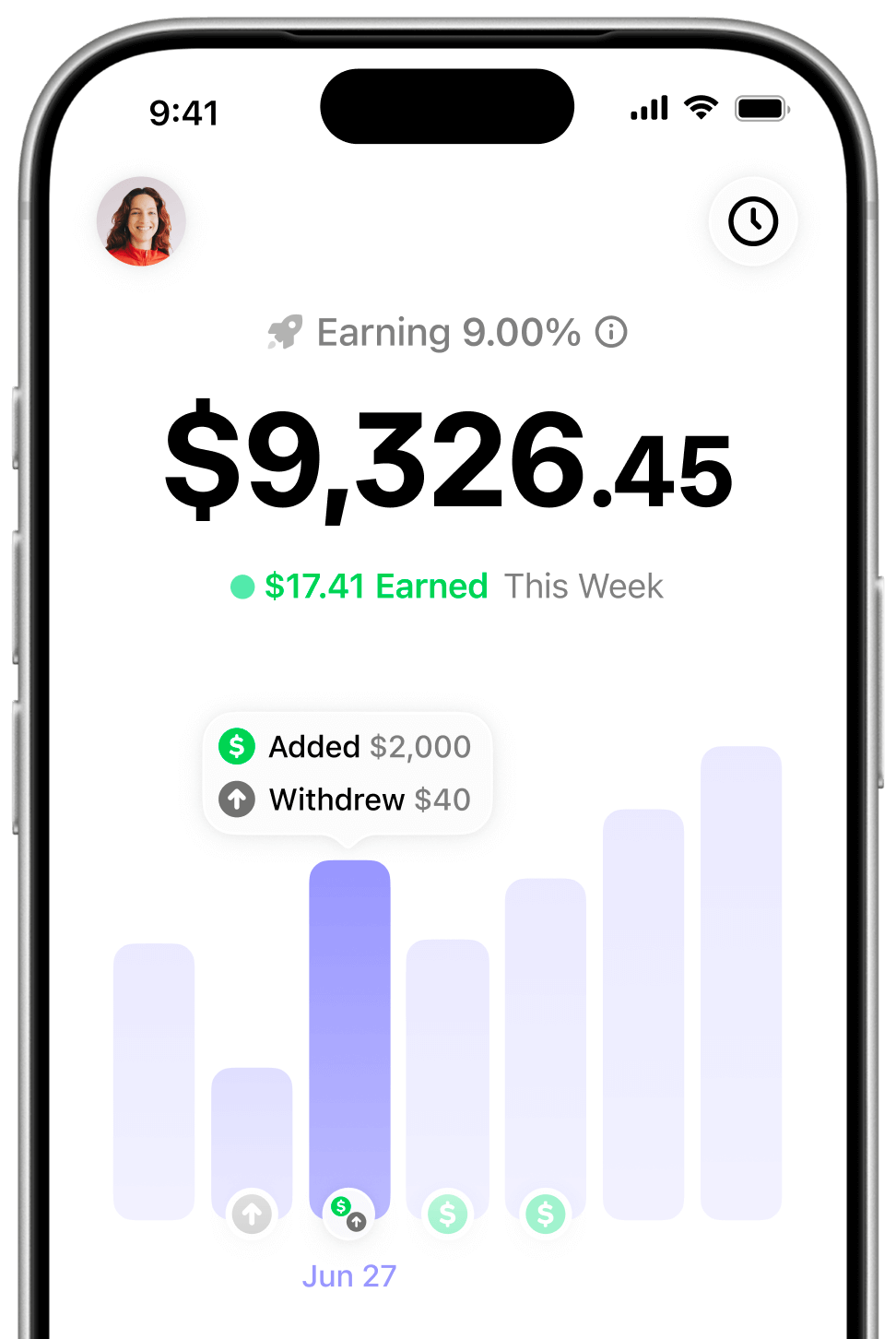

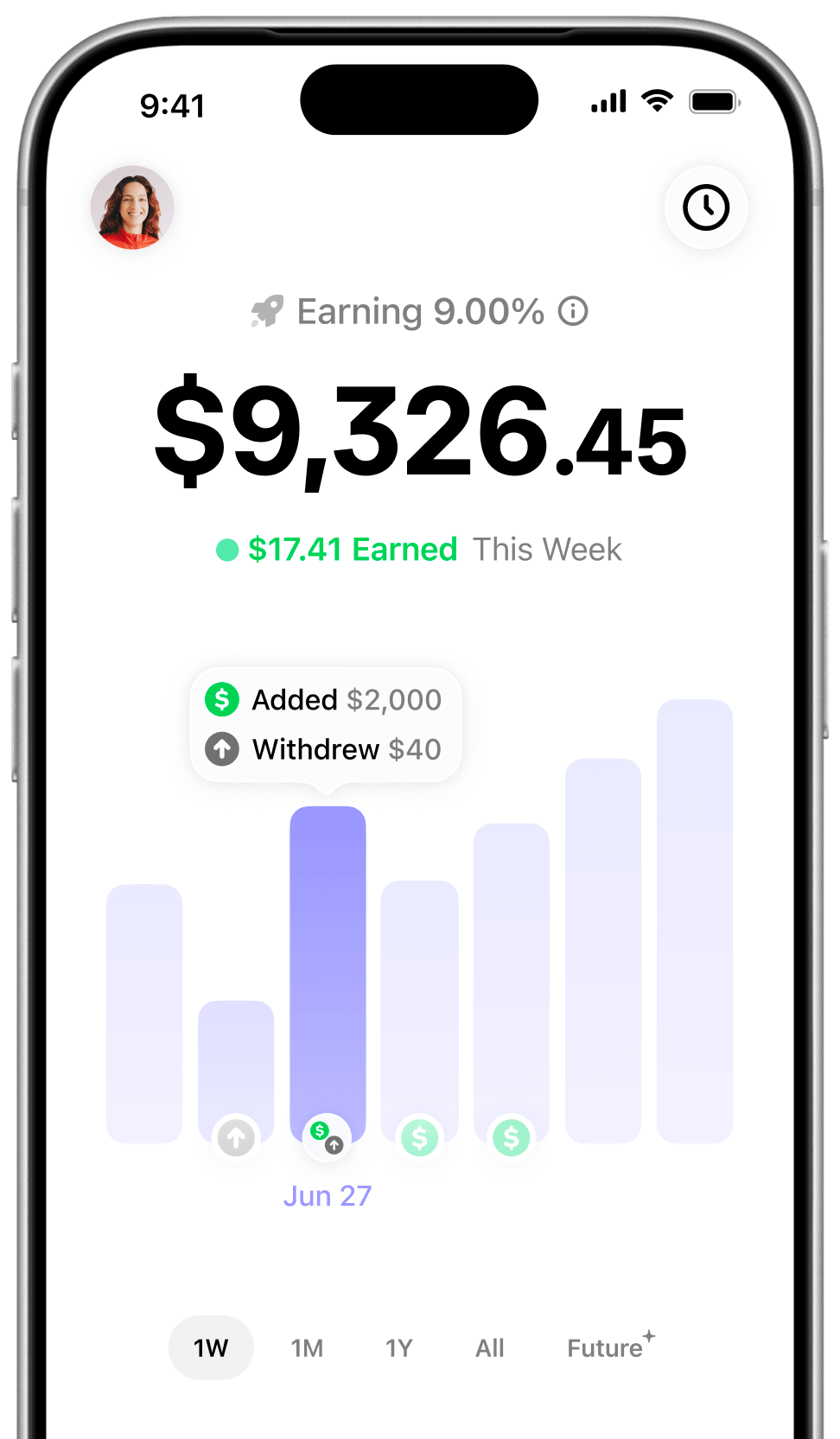

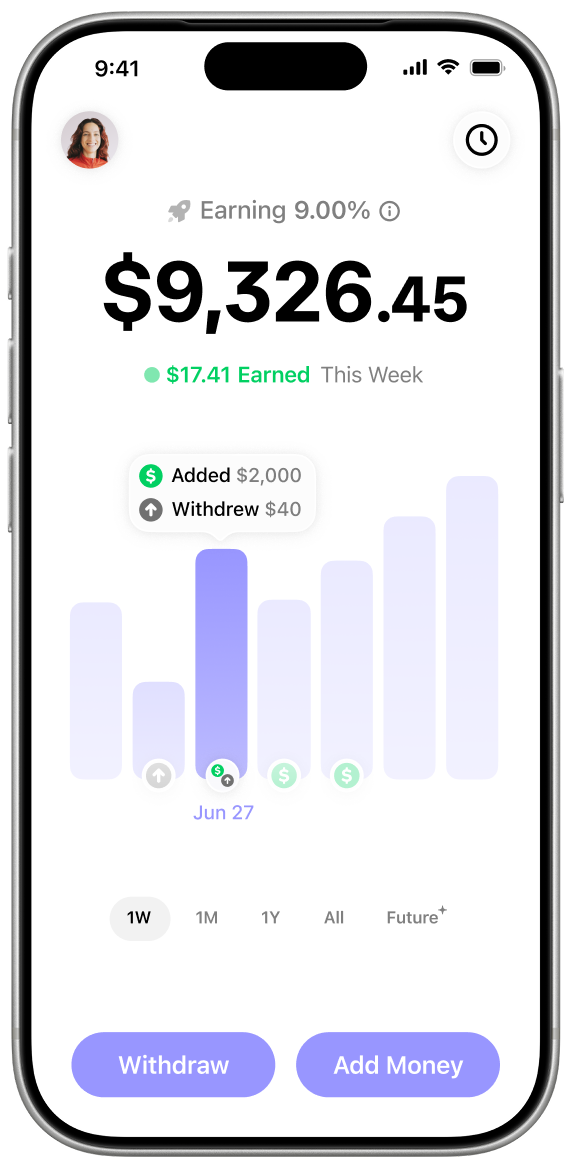

Visualize the power of compounding.

See how your money will grow over time.

Save your way.

Track your savings activity and create healthy habits.

Invite Friends. Earn More.

$

Assuming current base rate

Base APY

5.00%

Early Setup Boost

Friend Referral Boost ×

$200+ Recurring Contribution

Rates may vary. Learn More.

FAQs

- An insurance-backed coverage program for defined loss events such as security breaches or technology failures. The program is not yet active. Final terms, policy limits, and eligibility criteria will be announced upon launch.

- 3.50% is the advertised interest rate for Cash App savings accounts as posted on cash.app, as of November 13, 2025.

- 0.40% is the national average interest rate for savings accounts as posted on FDIC.gov, as of October 31, 2025.

- 3.50% is the advertised interest rate for Wealthfront cash accounts as posted on wealthfront.com, as of November 12, 2025.

- 3.60% is the advertised interest rate for SoFi High-Yield Savings Accounts as posted on sofi.com, as of November 12, 2025.

- 0.40% is the national average interest rate for savings accounts as posted on FDIC.gov, as of October 31, 2025.